Predictive Talent Intelligence

What the Top 1% of U.S. Physical Power Originators Are Quietly Saying Right Now

Attention – if you’re in the power origination game, this should be useful. Insights from the top performers delivering annually, the ones shaping the market. They’re sharing clear requirements;...

So if an $800m power plant looks like an accessory next to a $5bn data center…

what kind of talent becomes the real differentiator?

going to try live-tweeting the GPT-5 livestream. first, GPT-5 in an integrated model, meaning no more model switcher and it decides when it needs to think harder or not. it is very smart, intuitive, and fast. it is available to everyone, including the free tier, w/reasoning!

When Forecasts Boom but Hiring Hesitates

WHAT I’M HEARING ACROSS THE MARKET Over the past few months, nearly every conversation I’ve had with experts in Trading, Origination, and Analytics has circled back to the same paradox: U.S. power demand is forecast to grow ~2.5% per year - the fastest pace in decades. The Department of Energy estimates that nearly half of today’s energy workforce will retire within ten years....

Two weeks in Houston meeting with professionals driving the Power & Gas markets.

A challenging year across Origination & Trading - new entrants, volatility, and constant movement.

The real story this year is retention.

How are you keeping your top commercial talent?

Today we are launching my favorite feature of ChatGPT so far, called Pulse.

It is initially available to Pro subscribers.

Pulse works for you overnight, and keeps thinking about your interests, your connected data, your recent chats, and more.

Every morning, you get a…

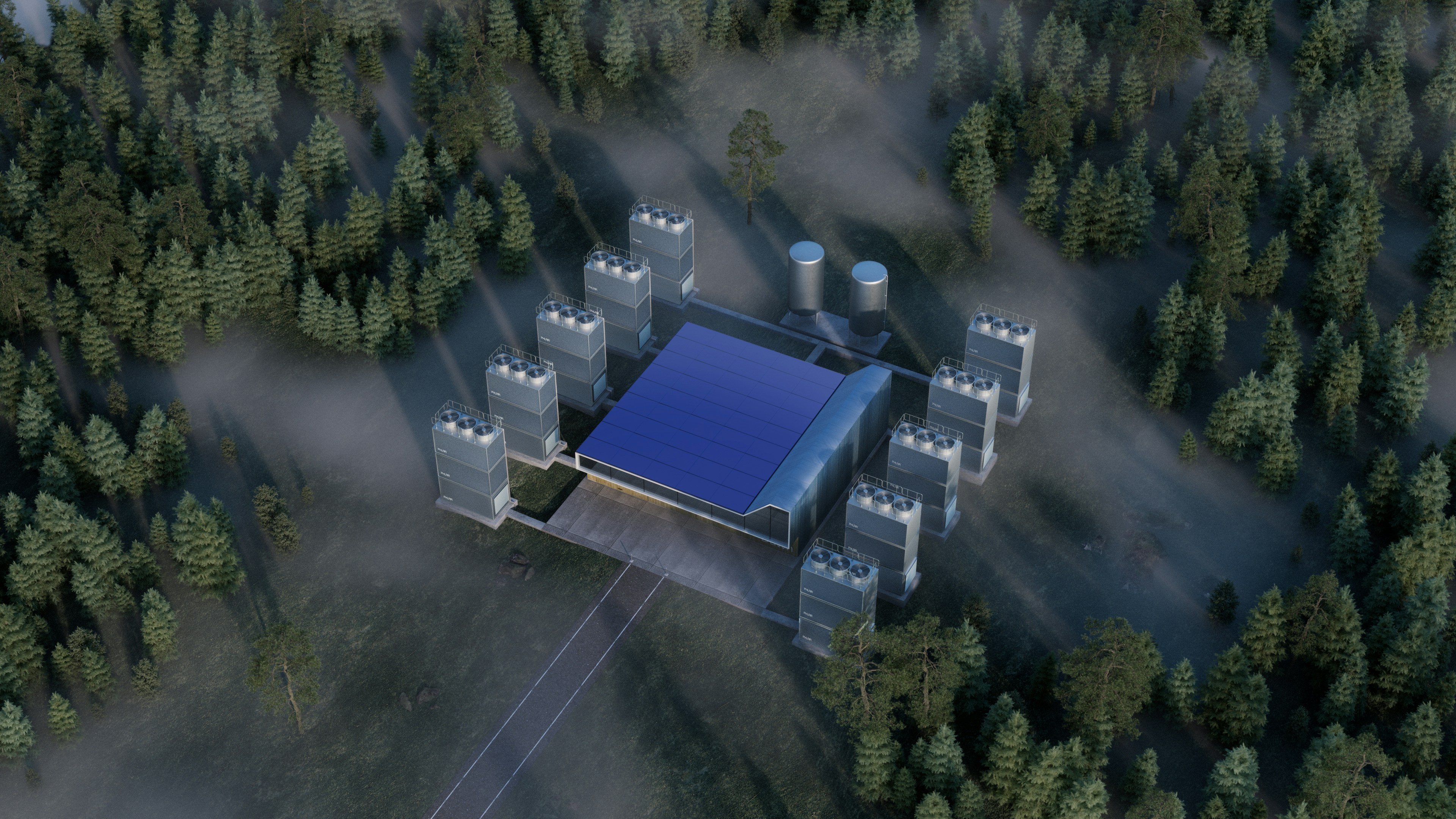

The typical architecture of an AI data center and comparison to traditional data centers

pic.twitter.com/9uCikhS9EN

Steve Jobs:

How to design insanely great products

pic.twitter.com/aSqQ9AAcGt

Spending the last few weeks in Houston connecting with the brightest minds solving Power & Gas market challenges.

The collaboration, openness and ambition here is infectious.

The golf courses are pretty good too.

Senior mandates shaping U.S. power & analytics;

VP Origination (PJM) – Lead structured deals w/ utilities, co-ops & C&I buyers.

VP Origination (WECC) – Hybrid PPAs, tolls & capacity.

Sr Quant Analyst (Houston) – ERCOT models using Python/ML.

Exploring the market?

Let’s talk.

#Origination #EnergyMarkets #Quant #ERCOT

Richard will be representing the Cedar Peak team in Houston for the next few weeks, catching up with clients, candidates, and industry leaders shaping the next phase of Power & Gas Markets.

He’ll also be speaking with firms exploring how AI and automation are being used to speed up deal flow, decision-making, and origination performance, themes that are reshaping the front office.

We’ve got a few Cedar Peak golf and padel meet-ups planned too, so if you’re around or heading to

#EnergyTradingWeekAmericas

it would be great to connect, whether it’s at the event, over coffee, or out on the course.

Power’s New Math: Data Centers, Capital, and Talent

open.substack.com/pub/richardlock1/p/powers-new-math-data-centers-capital

Newsletter dropping on Monday.

www.linkedin.com/posts/richard-lock-_every-conversation-ive-had-this-month-with-activity-7365014199971885056-85Xd

Power’s New Math: Data Centers, Capital, and Talent

For decades, U.S. power demand moved predictably - a steady 1–2% growth story that rarely made headlines. That era is over. The rise of large-scale data centers has transformed the demand curve almost overnight....

It’s not a capital problem - it’s a coordination problem.

Gas producers, power generators, hyperscalers, data center builders, regulators...

Everyone wants to move fast.

But without alignment, nothing moves.

👉 What’s the #1 blocker you're seeing right now?

#PowerMarkets

In power origination, the strongest teams I see have two distinct hunters:

1️⃣ Demand-side - public power, munis, co-ops, utilities.

Relationship-led, always in front of the customer.

2️⃣ Supply-side - IPPs, infrastructure funds, tolling.

Technical, deal-structuring pros.

Together → coverage, depth & resilience.

#PowerMarkets #Origination #EnergyTrading

x.com/search

In US power markets - and in the US more generally - senior leaders still take calls on the beach.

In Europe, they vanish for 3 weeks every summer without blinking.

Which model actually builds stronger businesses?

Houston Energy Talent:

What’s Really Driving Movement in 2025 Some great insights from a few weeks on the ground in Houston - meeting commercial leaders originators, and traders across the Power & Gas markets.

Senior professionals are increasingly leaving large organisations for leaner platforms where they can execute without red tape.

Across conversations, five clear themes kept surfacing:

• Credit and compliance bottlenecks slowing deal flow. • Compensation fatigue and flat bonus pools. • Cultural drift inside large corporates. • Burnout from leaner teams carrying more load. • Curiosity around AI, data, and automation transforming commercial decision-making.

Firms that trust their people to move faster - and give them space to perform, are keeping their best talent.

The rest are quietly losing them.

We’ve summarized the key findings and implications in our Houston Energy Talent Market Intelligence Report below.

Reach out if you’d like to discuss the full brief.

Houston Talent Intelligence Report

I spent two weeks in Houston meeting commercial leaders and front-office professionals across trading and origination. Different firms. Same story....

Got a call tonight from a power originator who’s a perfect fit for one of my live mandates.

Power of referrals - when you’ve built a defined network, the right people find you.

Hiring is hard

Gas originator wants to secure best deals in gas purchasing:

pic.twitter.com/T0UqiZq0fe

Excellent article from one of the Energy sector’s leading voices.

The energy transition is being re-evaluated to balance access, security, and affordability demanding tough trade-offs and coordinated action to build resilient diversified supply chains - and Cedar Peak Partners is at the forefront of driving the talent needed to lead this transformation.

Capital isn’t the problem - execution is.

Interconnection delays, hyperscaler timelines, queue reform, SB6 - the pressure is building.

Teams need people who’ve delivered under pressure before, not just modelled or advised from the sidelines.

At Cedar Peak, we’re working with:

- Originators who’ve closed tolling deals across gas and storage - Operators who’ve navigated site control and permitting - People who know how to move megawatts, not just pitch them If you're facing grid challenges or co-location headaches, we're working with people who’ve solved them!

Following a productive few weeks in Houston connecting with senior leaders across the Power & Gas markets.

We’re now representing a Senior Gas Originator search for a leading U.S. energy firm expanding its commercial platform.

This is a high-impact role within a performance-driven, entrepreneurial environment perfect for an Originator who thrives on building new market opportunities and driving commercial growth.

Reach out to Richard Lock to discuss the opportunity in more detail.

Full brief below www.linkedin.com/in/richard-lock- lnkd.in/ekmMDGzH

Blackstone $BX COO Jon Gray described the next ‘big thing’ across three categories:

1) Chips

2) Data Centers

3) Power They've projected a 40% increase in US electricity demand over the next 10 years.

The first two categories depend entirely on the third, making electricity…

pic.twitter.com/tEpN1PCbK2

After Day 1 at Energy Trading Week…

When does AI stop being a tool - and start becoming the operating system we live in?

@elonmusk - thoughts?